-

New Partay!!

Same as old Partay!

-

End of week party post

-

New week, new post

-

This is the End and a New Beginning

This is the End and a New Beginning

-

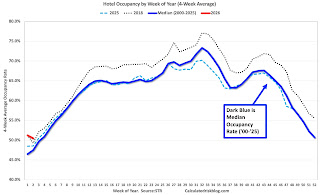

Hotels: Occupancy Rate Increased 4.4% Year-over-year

Hotels: Occupancy Rate Increased 4.4% Year-over-year

-

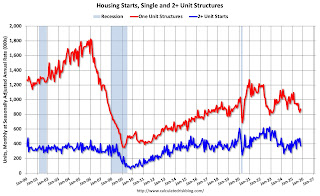

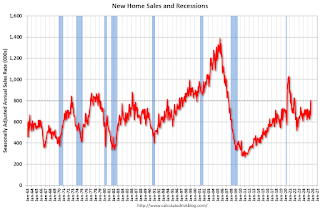

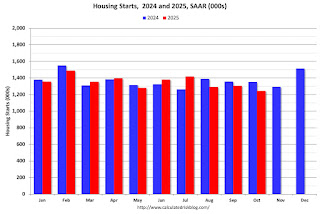

Real Estate Newsletter Articles this Week:Housing Starts Decreased to 1.246 million Annual Rate

Real Estate Newsletter Articles this Week:Housing Starts Decreased to 1.246 million Annual Rate

-

Schedule for Week of January 11, 2026

Schedule for Week of January 11, 2026

-

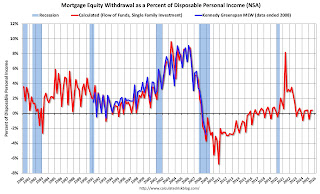

The "Home ATM" Mostly Closed in Q3

The "Home ATM" Mostly Closed in Q3

-

Fed’s Flow of Funds: Household Net Worth Increased $6.1 Trillion in Q3

Fed’s Flow of Funds: Household Net Worth Increased $6.1 Trillion in Q3

-

Newsletter: Housing Starts Decreased to 1.246 million Annual Rate in October

Newsletter: Housing Starts Decreased to 1.246 million Annual Rate in October